By: Gerd Hado, Director of Business Development and Marketing

Digital payment fraud is rising rapidly, especially authorized push payment (APP) fraud, where scammers deceive individuals and businesses into transferring money to fraudulent accounts. The European Payments Council (EPC) reports significant growth in these scams (EPC – 2024 Payment Threats and Fraud Trends Report). In the UK, APP fraud caused losses of £341 million in 2023, despite a 12% decline from the previous year. The first half of 2024 alone saw losses of £213.7 million (UK Finance, 2024).

In the broader European Economic Area (EEA), total payment fraud reached €4.3 billion in 2022 and €2.0 billion in the first half of 2023. Although specific APP fraud figures are not detailed, UK data highlights its severity and potential European impact.

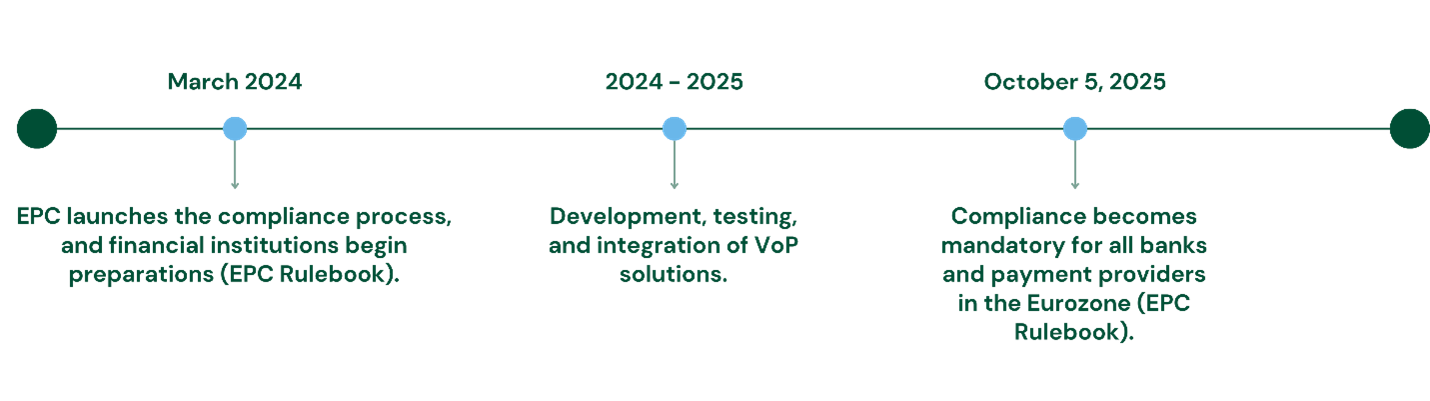

To combat this, the EPC introduced the Verification of Payee (VoP) rule, which verifies account details before processing payments. By October 5, 2025, all European banks and payment providers must comply (EPC Rulebook).

Verification of Payee (VoP) is an essential security measure designed to prevent fraud and mistakes in bank transfers. VoP checks whether the recipient’s name matches the associated bank account. If there’s a mismatch, the sender receives an alert before the payment proceeds, allowing cancellation.

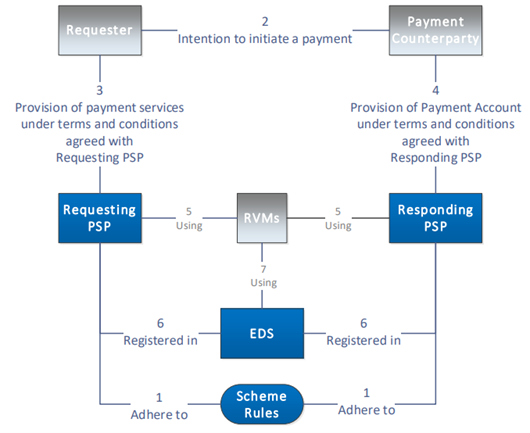

Source: Verification of Payee Scheme Rulebook – European Payments Council

VoP significantly enhances digital payment safety:

Its primary benefit is fraud prevention. In APP fraud cases, VoP adds an extra security layer, making it harder for scammers to succeed (EPC – 2024 Payment Threats and Fraud Trends Report). Additionally, VoP reduces errors, minimizing costly disputes and mistakes. By making transactions more secure and reliable, VoP boosts trust in online payments, crucial for both consumers and businesses.

Benefits of Verification of Payee (VoP) for Consumers

VoP offers enhanced protection for consumers, ensuring money reaches the intended recipient. Simple errors like entering incorrect account numbers or invoice scams can cause significant losses (EPC – 2024 Payment Threats and Fraud Trends Report). VoP alerts consumers if provided details don’t match, preventing these errors and providing peace of mind during online and mobile banking.

The EU’s draft Payment Services Regulation (PSD3/PSR) from 2023 grants consumers additional refund rights in cases of failed IBAN/name verification and spoofing fraud, where fraudsters impersonate bank employees, tricking consumers into harmful financial actions.

In the UK, the Payment Systems Regulator (PSR) requires sending and receiving payment service providers (PSPs) to equally share reimbursement costs (50% each) when customers fall victim to APP fraud.

Source: Verification of Payee Scheme Rulebook – European Payments Council

The rollout of VoP is structured to give financial institutions time to prepare:

Facilization has been officially listed as a Routing and/or Verification Mechanism (RVM) Provider by the European Payments Council, demonstrating our capability in supporting financial institutions with VoP compliance. You can find our listing here: EPC RVM Listing.

Facilization provides tailored VoP solutions to help financial institutions meet regulatory requirements without disrupting operations. Our services include:

The Verification of Payee rule marks a major advancement for secure digital payments in Europe. By 2025, mandatory compliance will significantly reduce fraud, errors, and enhance consumer trust (EPC – 2024 Payment Threats and Fraud Trends Report).

Facilization is dedicated to ensuring a smooth transition to VoP compliance for businesses and banks.

Stay Ahead of VoP Compliance!

Contact Facilization today to protect your payments.