Forget what you know about the Balkans. Albania is no longer just a scenic stop on the Adriatic and Ionian coast. It’s becoming the region’s most dynamic fintech lab. And for savvy investors, it’s the clean slate you’ve been waiting for.

A new market, hungry for technology

Albania presents a rare opportunity that many developed markets have long outgrown. With no dominant fintech players like Revolut, N26 or Klarna, the Albanian market offers a clean slate for creating and scaling innovative financial solutions.

In recent years, more and more fintech startups have been developing financial services based on one philosophy: “fewer branches, more APIs; less paperwork, more deep insights.”

These achievements are being realized in a favorable environment, where the demand for fast, accessible, and personalized services is at its peak.

Digital Finance by the Numbers: 5 Years of Sustained Growth

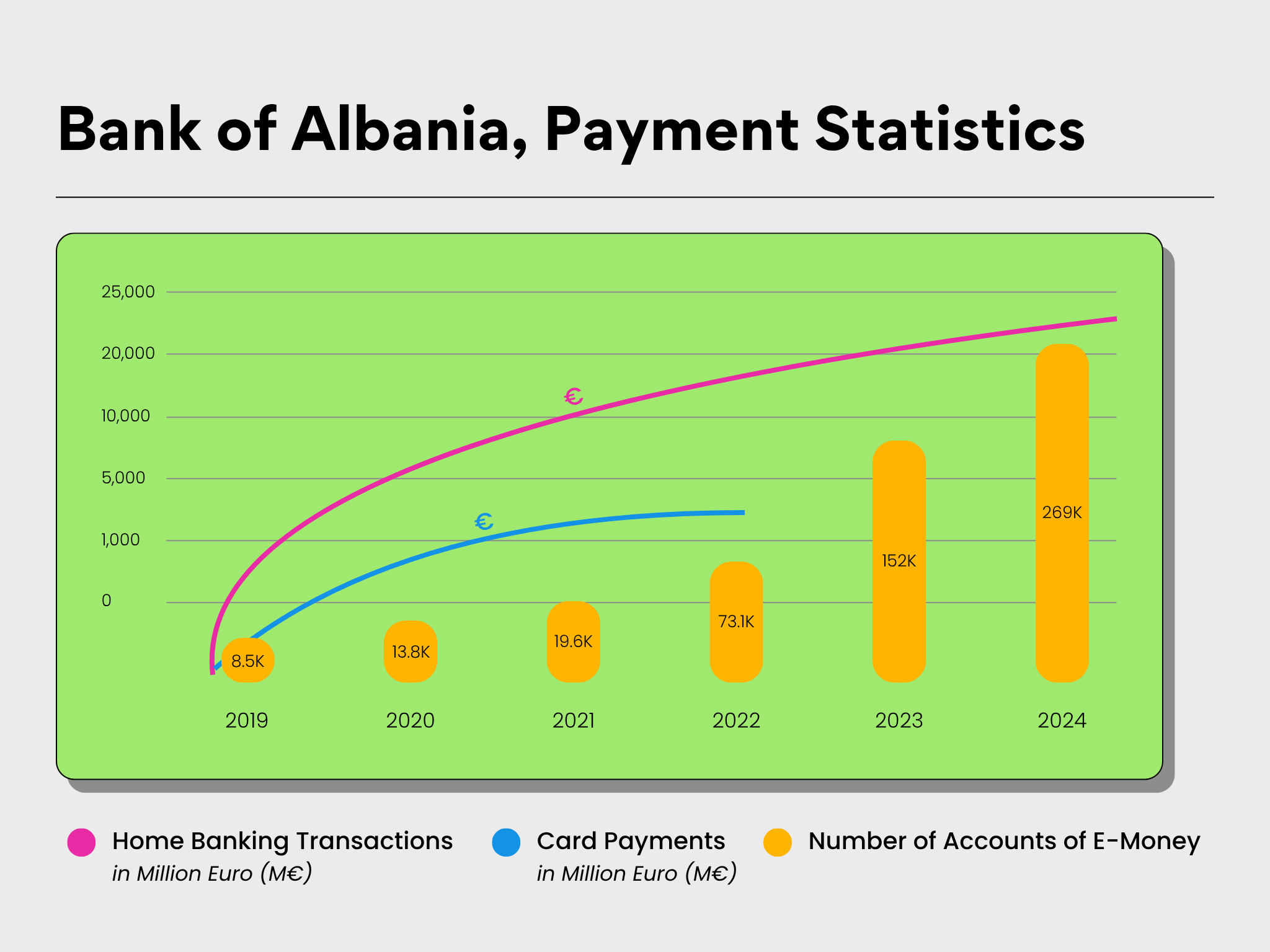

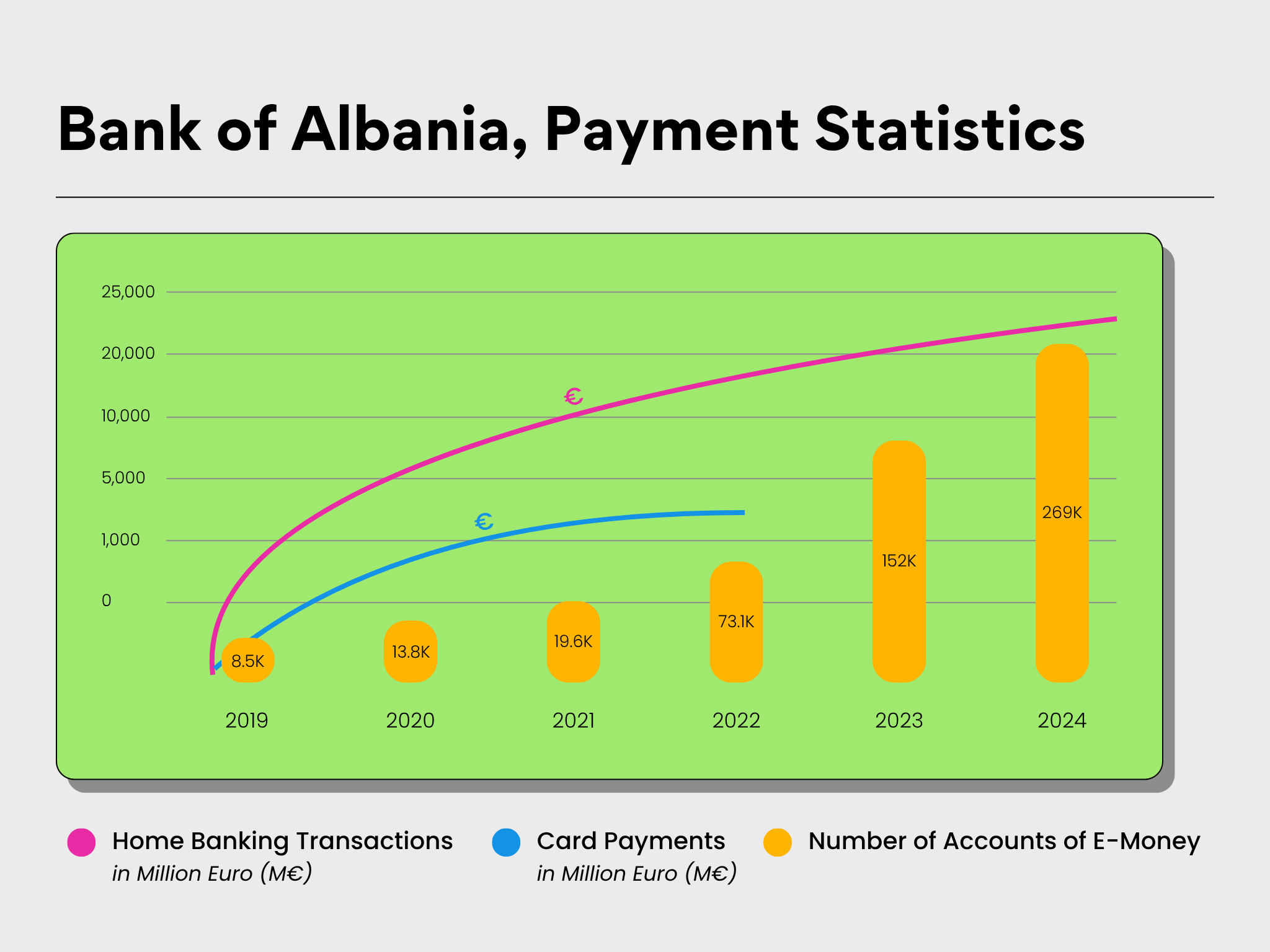

Although the transition to a cashless economy is far from complete, between 2019 and 2024 (Bank of Albania, Payment Statistics), Albania’s digital finance indicators tell a clear story of momentum and transformation:

The figures point not just to adoption, but to acceleration. Albanian consumers are moving beyond early-stage experimentation—digital finance is becoming part of everyday life.

Albania as a natural incubator for new fintech solutions

Unlike some other Balkan markets, Albania provides unique conditions for fintech innovation, including flexibility and rapid adoption of innovation. There’s no need for new solutions to displace firmly rooted systems; instead, they can coexist and succeed with less resistance.

Additionally, Albania’s regulatory landscape is rapidly aligning with European Union standards. Key developments, like Open Banking initiatives and the country’s integration into the Single European Payments Area (SEPA), create a secure and forward-looking ecosystem for fintech players. With a high adoption rate and steadily increasing digital channel users, Albania serves as a natural sandbox for fintech solutions.

More than technology: infrastructure, experience, and trust are required

Transformation is not achieved solely through enthusiasm or foreign investments. It requires the support of those who deeply understand the terrain, the regulations and have experience in building systems that stand the test of time. Facilization, with over 15 years of experience in digitizing the financial sector in Albania and across Europe, has helped Albanian banks achieve significant changes, including the transition from manual data processing to automated reporting and analysis, from mobile-based interactions to data-driven self-service solutions, and from fragmented processes to integrated digital architectures.

Facilization not only supports well established banks and financial institutions but also offers tailored solutions for market entrants. By providing core banking and digital banking systems customized to their unique vision, Facilization helps build platforms from conception to post-implementation maintenance. These services take into account the need for maximum speed and flexibility that new banks require to succeed.

Why should international investors turn their attention to Albania today?

The fintech sector in Albania offers unique opportunities for investors seeking high growth potential:

These factors create an ideal environment for scaling innovation and reaping the benefits of a high growth fintech ecosystem. With its unique combination of flexibility, demand and supportive infrastructure, Albania is quickly shaping up to be a regional hotspot.

Gerd Hado

Director of Business Development and Marketing, Facilization

(this article was featured on Monitor)