Routing secure payments with accurate matching solution

By enhancing the security and accuracy of digital payments, VoP fosters greater trust in online transactions, benefiting both businesses and consumers, either in a payer or payee role.

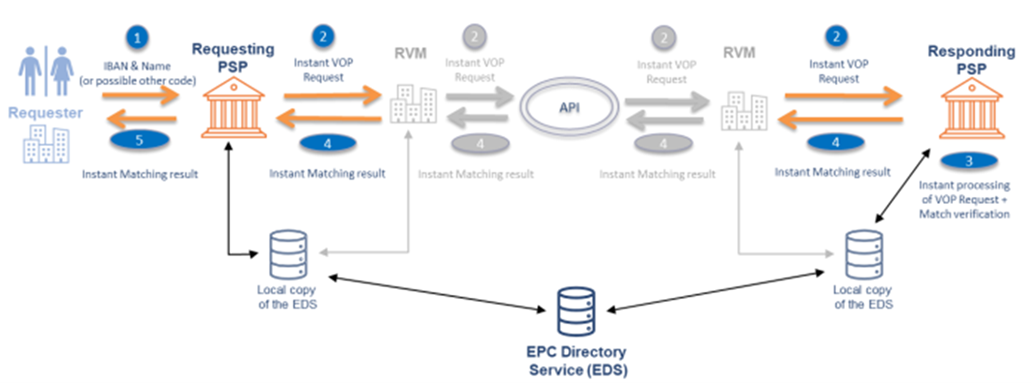

RVMs are mechanisms that ensure that every verification request is routed securely to the correct Payment Service Provider (PSP) while maintaining full compliance with EPC standards. They are the backbone of VoP transactions.

Who needs an RVM? Any PSP and payment clearinghouse that requires compliance with the EPC rulebook and wants to enhance payment security.

Product Development Director

Oqeania Pepellashi is a highly skilled Product Manager and Executive Board Member with a specialization in FinTech and SaaS solutions. With extensive experience in digital transformation, she leads the development of cutting-edge products in Digital Lending, Low Code Platforms, Cloud Data Solutions.

Read moreOqeania Pepellashi is a highly skilled Product Manager and Executive Board Member with a specialization in FinTech and SaaS solutions. With extensive experience in digital transformation, she leads the development of cutting-edge products in Digital Lending, Low Code Platforms, Cloud Data Solutions.

Oqeania joined Facilization in September 2023 as a Product Development Director and has since been instrumental in driving product innovation, project execution and the integration of fintech solutions. With deep expertise in payments, Oqeania has played a key role in shaping Facilization’s solution strategy for our VoP/ RVM offering.

She plays a key role in driving innovation through strategic partnerships and is a keynote speaker at global conferences, where she shares her expertise in shaping the future of digital financial solutions.

Holding an Oxford Fintech Programme certification from Saïd Business School, coupled with a master’s in management information systems, Oqeania combines deep technical expertise with strategic business acumen to drive innovation in the product development team.

x

Solution Architect

As a Solution Architect for Facilization, Olti designs solutions for Digital Banking, with the mission to enable a smooth and effective digital transformation for the Banking Sector. Through effective collaboration with our partners and within the organization, he facilitates the preparation of turnkey solutions for our customers.

Read moreAs a Solution Architect for Facilization, Olti designs solutions for Digital Banking, with the mission to enable a smooth and effective digital transformation for the Banking Sector. Through effective collaboration with our partners and within the organization, he facilitates the preparation of turnkey solutions for our customers.

Olti joined Facilization in early 2011 as a Product Developer and has since played a leading role in product development, project management and implementation, and integration of Digital Banking Applications. A special contribution he has given in the development and implementation of BI and Data Warehouse solutions.

He started his career in 2006 in the IT Department of Alpha Bank Albania, where he became a supervisor of the Software Development Section and later, a supervisor of the Banking Application Section. Since 2009, he has been lecturing at the University of Tirana.

Olti graduated in Computer Science (5 years program) in 2008 with excellent grades from the Faculty of Natural Sciences in the University of Tirana. He has a Master of Science Degree in “Advanced Information Systems” and since 2014 he holds a Ph.D. in Computer Science.

x